new market tax credit map 2020

Both sets of data2006-2010 data and 2011-2015 American Community Survey ACS low-income community LICwill be available in the NMTC Mapping Tool. The lookback period previously included transactions closed by May 31.

New Markets Tax Credit Investments In Our Nation S Communities

Novogradac highlights important New Market Tax Credit NMTC application information for CY 2020 including allocation info and FAQs.

. 11 rows New Markets Tax Credit Program allocatees can make investments in all 50 states the District of Columbia Puerto Rico and certain US. Business Development Manufacturing. The New Markets Tax Credit Coalition today released its 2021 New Markets Tax Credit NMTC Progress Report the seventeenth edition of the reportproviding analysis of NMTC activities in 2020.

9 2020Application for NMTC Program CY 2020 UpdatedOct. It also costs an average of more than 53000 in NMTC investment to generate a job. Lake Forest CA July 23 2020 Clearinghouse Community Development Financial Institution Clearinghouse CDFI announced today that it has been awarded a 65 million New Markets Tax Credit NMTC allocation from the United States Department of TreasuryClearinghouse CDFI will use the tax credits to finance the development of community.

These investments will create jobs and spur economic growth in urban and rural communities across the country Secretary of the US. From 2003 through 2020 the program has parceled out credits worth 26 billion in 2020 dollars. Projects closed on or after Nov.

The goal of the program is to stimulate investment in low-income areas. The New Markets Tax Credit NMTC was established in 2000. Generated 8 of private investment for every 1 of federal funding.

The NMTC has supported more than 5300 projects in all 50 states the District of. The map above and the search function below will display results by service area for allocatees that have received awards from 2012 to the present. Wednesday May 4 2022.

NMTCs provide access for low-income residents low-income persons and low-income communities to realize their goals and plans. Over the last 15 years the NMTC has proven to be an effective targeted and cost-efficient financing tool valued by businesses communities and investors. Total credit equals 39 of the original amount invested in the CDE.

The NMTC allocation for the 2020 round is set at 5 billion in tax credit allocation authorityan increase of 15 billion over the 35 billion allocated in NMTCs initially authorized for 2019. This tool and the data in the searchable map below reflects historic tax credit. June 17 2021 0900 AM Eastern Daylight Time.

The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005. As of the end of FY 2020 the NMTC Program has. The New Markets Tax Credit NMTC was designed to increase the flow of capital to businesses and low income communities by providing a modest tax incentive to private investors.

New Markets Tax Credit Benefits. CIMS4 users can create and save maps and reports including Target Market worksheets and submit saved maps and. In plain terms the New Market Tax Credit.

5 of the original investment amount in each of the first three years. The NMTC Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities. 1 2018 must use 2011-2015 ACS low-income community eligibility data applied to the 2010 census tracts for.

To change the time frame to 2006-2010 click. Whether it is growth in the industrial park and access to quality accessible jobs increased access to affordable healthcare and workforce training or the rejuvenation. The CDFI Information Mapping System v4 CIMS4 is now available for geocoding addresses mapping census tracts and counties and determining the eligibility of census tracts and counties under the CDFI Funds various program distress criteria.

A total of 100 Community Development Entities CDEs were awarded tax credit allocations made through the calendar year CY 2020 round of the New Markets Tax Credit Program NMTC Program. Community Leaders on the New Markets Tax Credit. The 2011-2015 data is displayed by default.

When a user clicks on the map the info bubble displays values based on the 2011-2015 eligibility data. Awards will Spur Economic and Community Development Nationwide WASHINGTON The US. Address Social Media.

Seven-year credit period for every dollar invested and designated as a QEI. Commercial real estate developers use the NMTC program to secure advantageous debt and equity terms for developments. First it costs around 23500 in NMTC-subsidized investment to raise a person in a community near the median family income threshold out of poverty.

21 2020Application for NMTC Program CY 2020Sep. NMTC Celebrates 20 Years Nearly 6400 Projects Financed and Over One Million Jobs. The Community Development Financial Institutions CDFI Fund this week sent a letter to new markets tax credit allocatees with calendar year CY 2015-2020 allocation agreements announcing a change to extend the 36-month lookback period to Dec.

The New Markets Tax Credit is taken over a 7-year period. WASHINGTON June 30 2020 PRNewswire -- The New Markets Tax Credit Coalition today released its 2020 New. The map displays allocatees that have.

The NMTC program provides tax credits for investment into operating businesses and development projects located in qualifying distressed communities by certified Community Development Entities CDEs. 2020CDFI Fund Releases Application Demand for CY 2020 Round of the NMTC ProgramDec. The credit rate is.

The data presented below are provided as a reference and the validity of the data cannot be guaranteed. Department of the Treasurys Community Development Financial Institutions Fund CDFI Fund announced 5 billion in New Markets Tax Credits today that will spur investment and economic growth in low-income urban and rural communities nationwide. Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants.

And 6 of the original investment amount in each of the final four years. In contrast with the Earned Income Tax Credit EITC an anti-poverty tax credit that subsidizes work among. The CDFI fund provided the allocation availability notice PDF 209 KB which is scheduled to be published in the Federal Register on September 23 2020.

The New Markets Tax Credits program or NMTC is a component of the Community Renewal Tax Relief Act of 2000. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400. About the Novogradac Historic Tax Credit Mapping ToolDisclaimer.

The NMTC Funded 272 Projects and more than 45000 Jobs Across the US. Manner of Claiming the New Markets Tax Credit. A taxpayer may claim the NMTC for each applicable year by completing Form 8874 New Markets Credit and filing the form with the taxpayers federal income tax return.

All data should be verified with the applicable state and federal agencies before using it in the decision making process.

New Markets Tax Credit Investments In Our Nation S Communities

Production Incentives Map And Comparison Tool Cast Crew

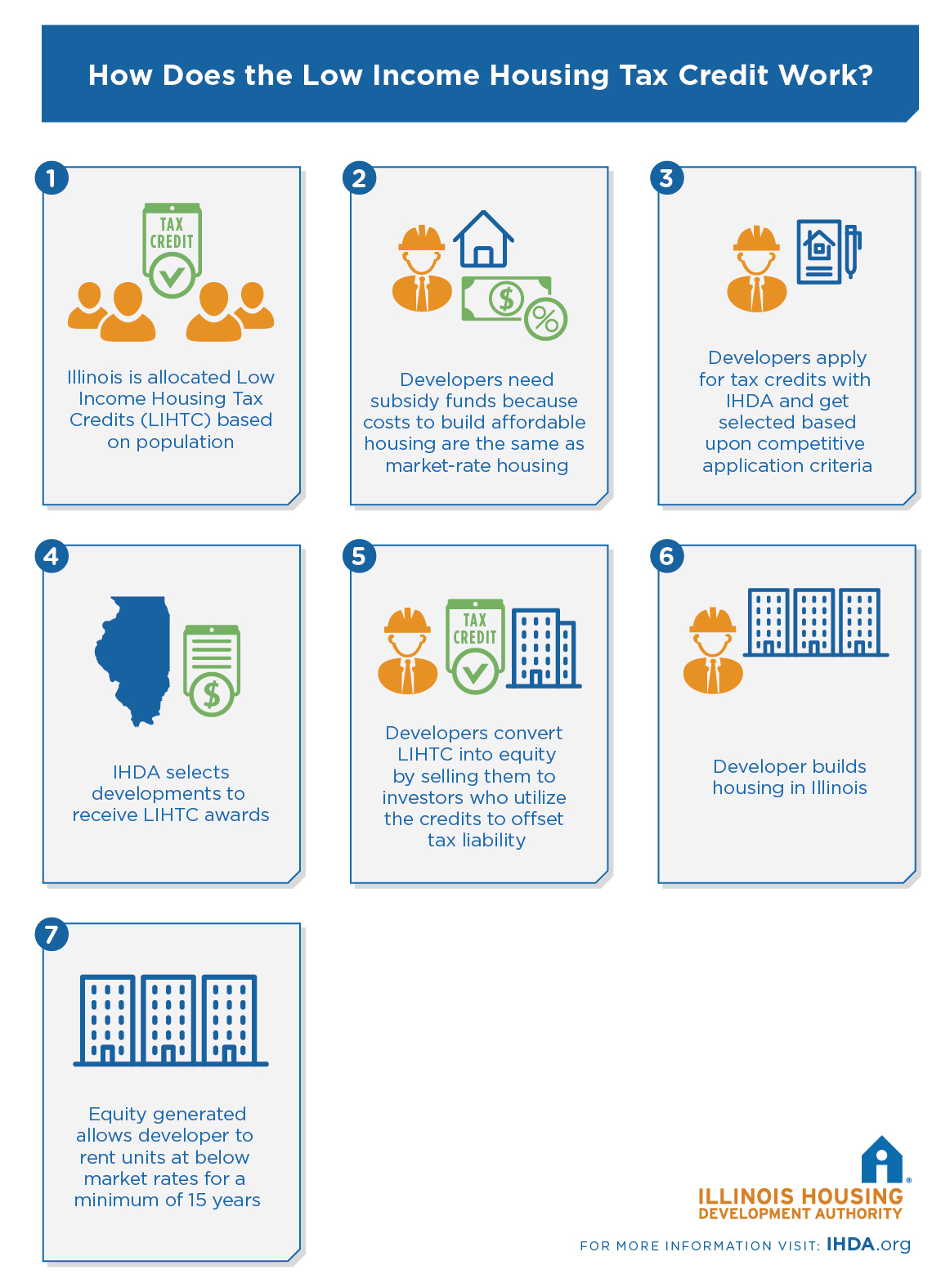

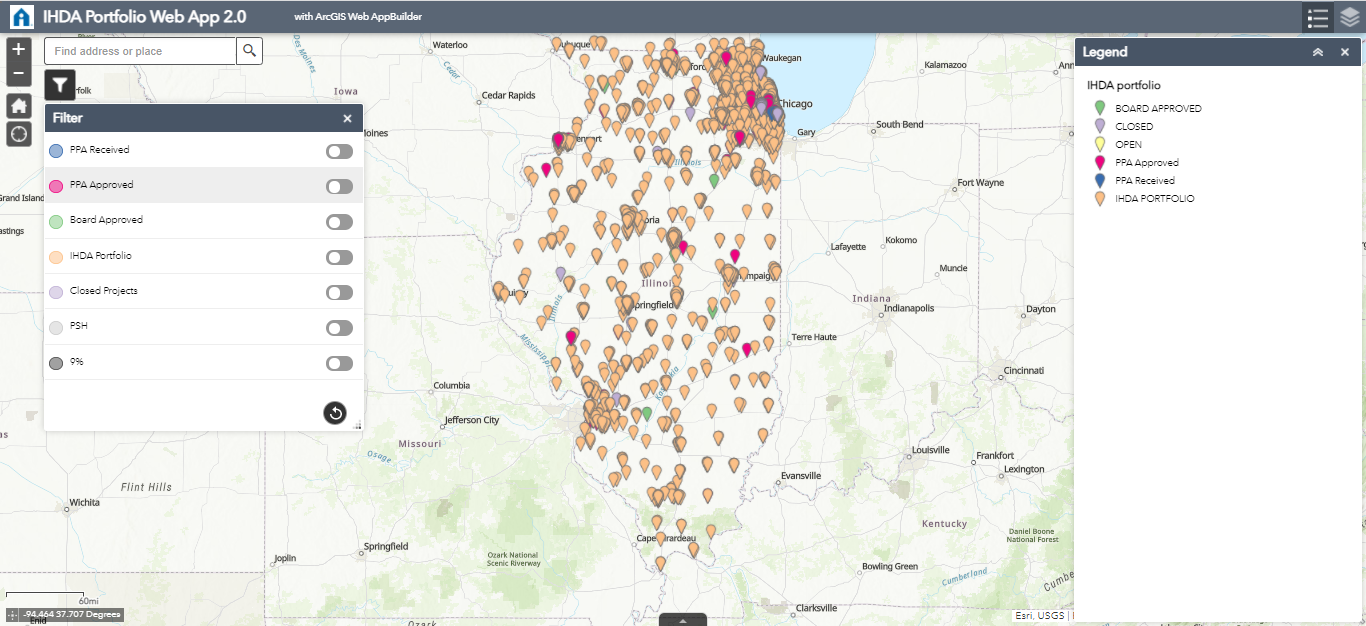

Low Income Housing Tax Credit Ihda

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Nmtc Allocatee Awards Community Development Financial Institutions Fund

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

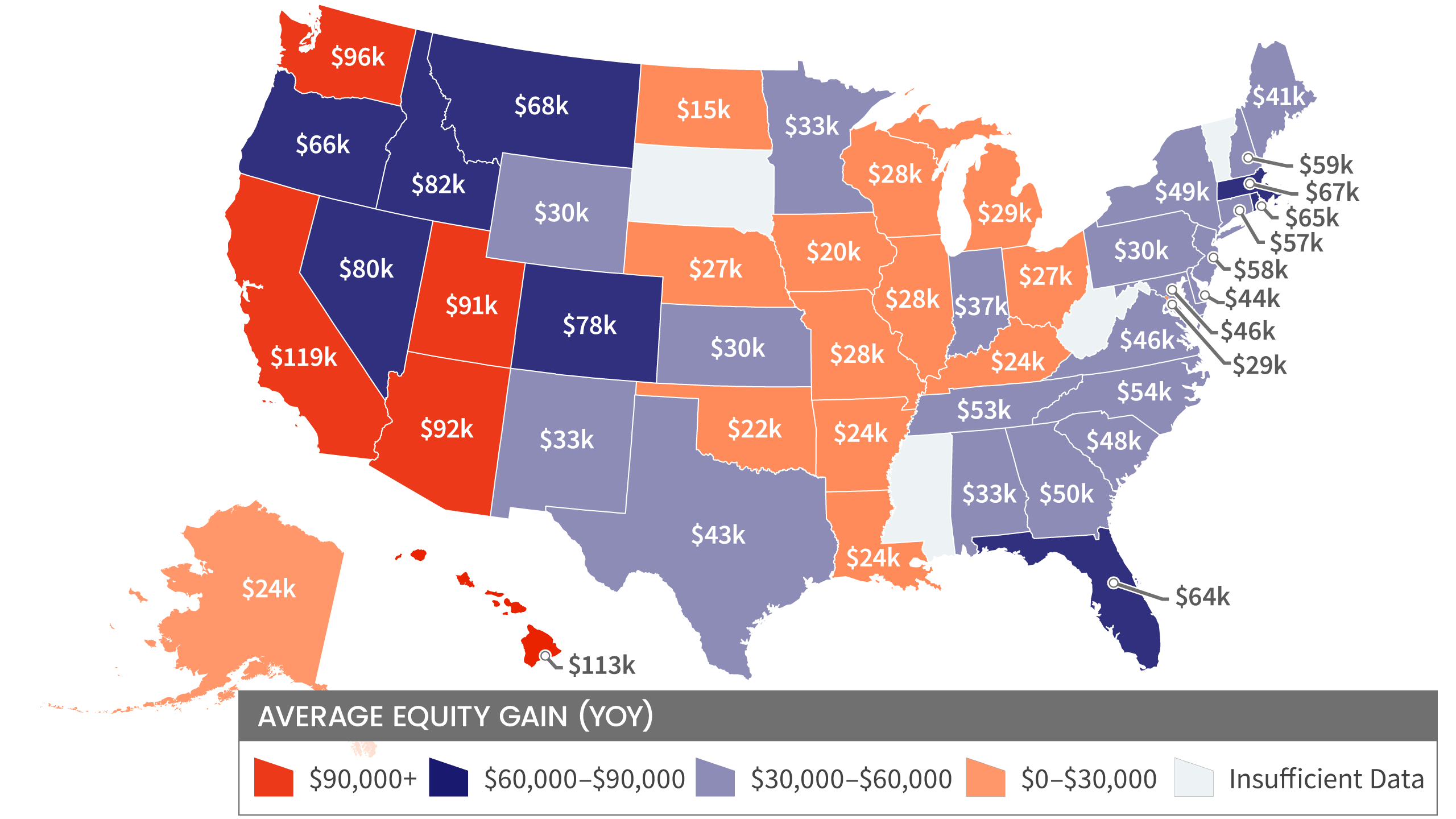

Homeowner Equity Insights Corelogic

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

New Markets Tax Credit Investments In Our Nation S Communities

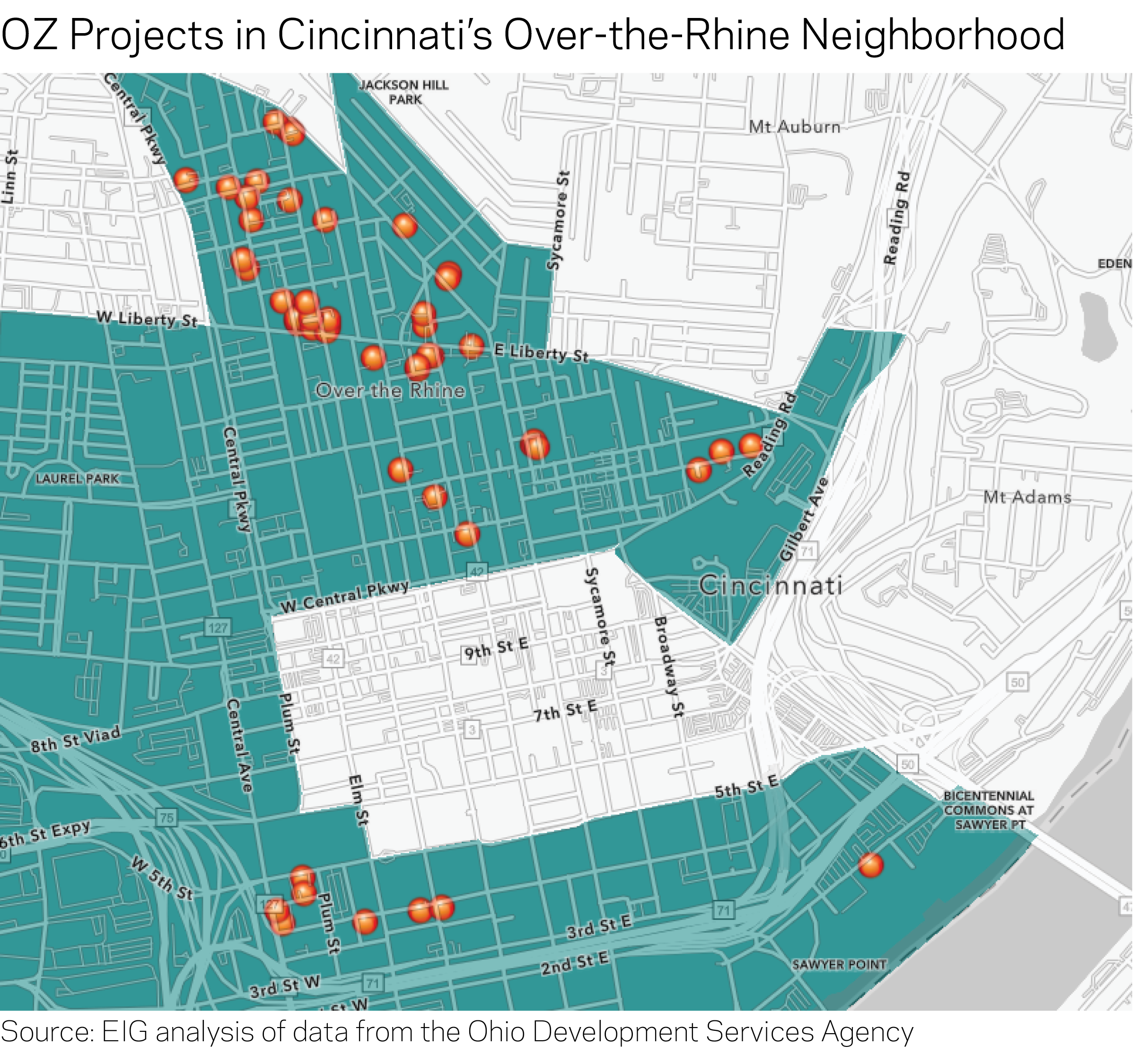

A First Of Its Kind Exploration Of Ohio S Opportunity Zone Investments Economic Innovation Group

Download Open Census Data Neighborhood Demographics

Corporate Retention Recruitment Business Utah Gov

Premiums And Tax Credits Under The Affordable Care Act Vs The American Health Care Act Interactive Maps Kff

New Markets Tax Credit Investments In Our Nation S Communities

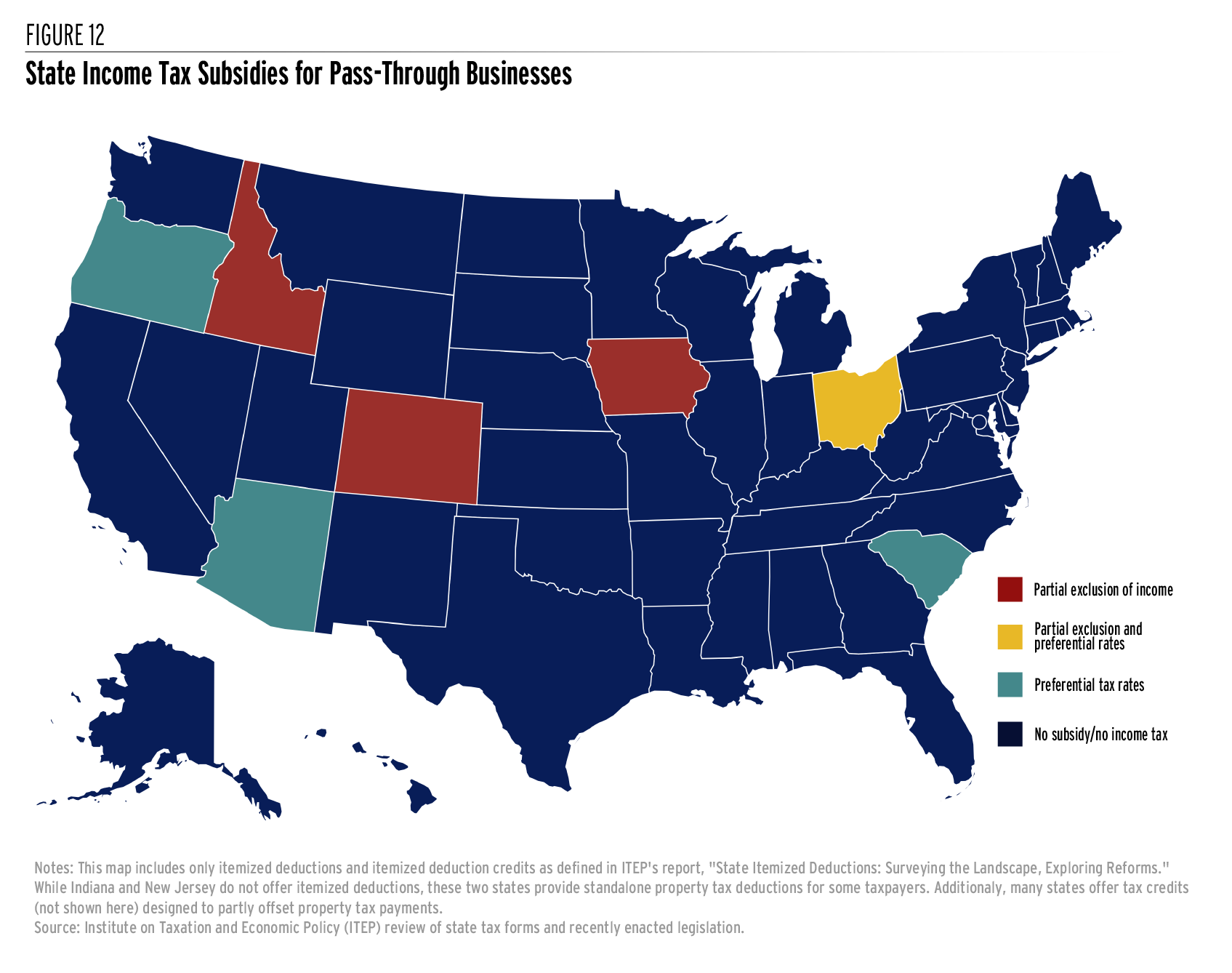

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Manufacturing The Future Of Clean Energy With 48c Third Way

Low Income Housing Tax Credit Ihda

Welcome To The Cdfi Fund Cims Mapping Tool Community Development Financial Institutions Fund